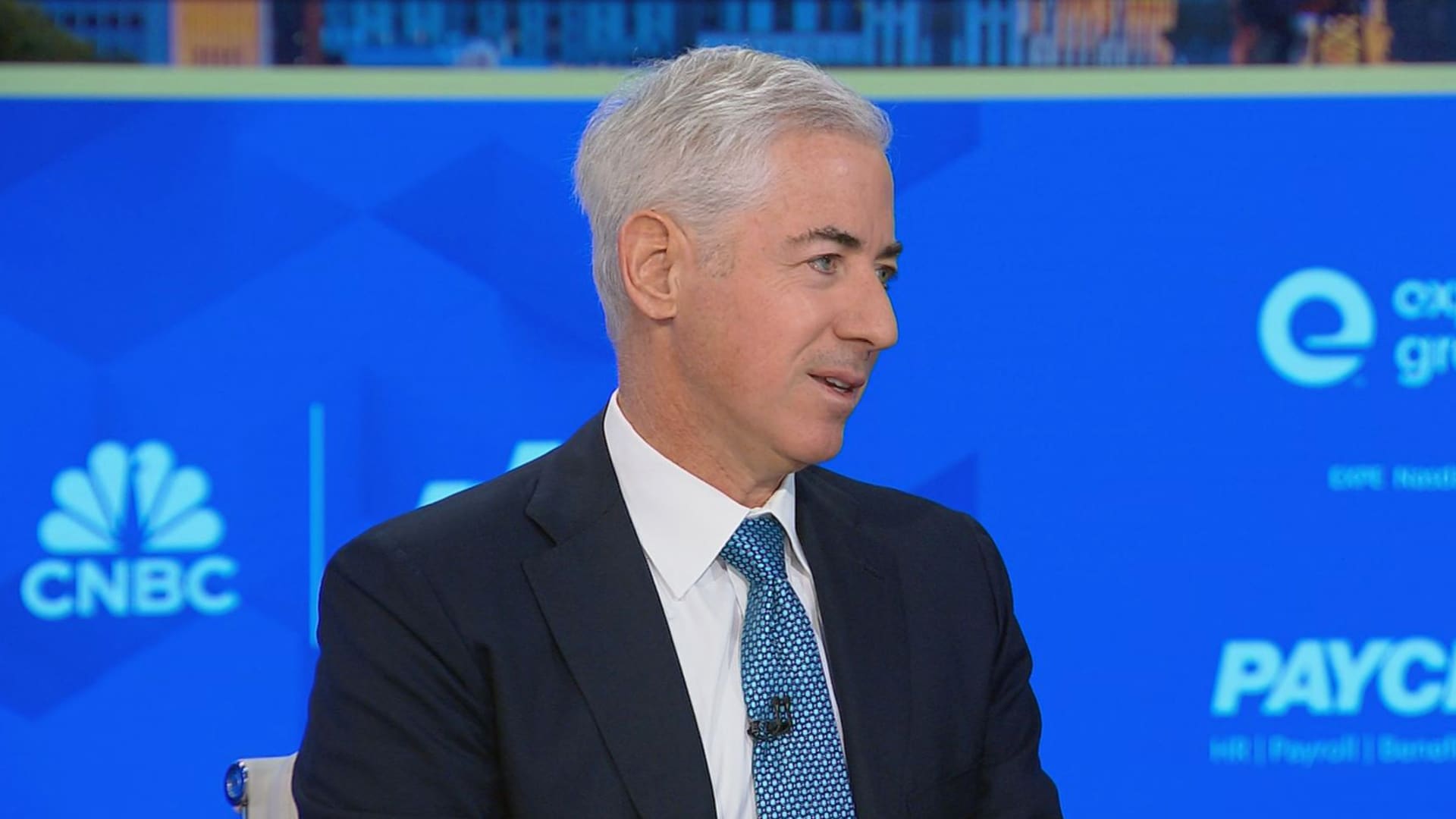

Ackman’s Pershing Square bet big on Amazon in fourth quarter

Bill Ackman ‘s Pershing Square poured hundreds of millions of dollars into Amazon shares as 2025 wrapped up. The fund expanded its stake by more than $865 million, or by 65%, to a value above $2.2 billion in the fourth quarter of last year, regulatory fillings show. Pershing’s Amazon holding is now its third largest, sitting behind Brookfield and Uber , according to InsiderScore. Ackman’s move came as Amazon’s stock jumped 5% in the three-month period, ending 2025 higher by around the same amount. But the e-commerce giant has fallen on harsher times since, sliding more than 12% in the first quarter of 2026. The stock on Tuesday snapped a nine-day losing streak that erased more than $450 billion in market cap. AMZN 1Y mountain Amazon, 1-year The lion’s share of analysts polled by LSEG have buy ratings on the stock. Their average price target suggests shares can rebound by more than 38% over the next year. Ackman announced a stake in Meta earlier this month that accounted for around 10% of the firm’s portfolio at the end of last year. The billionaire investor said the stock had a “deeply discounted valuation.” Pershing’s position in the Facebook parent is worth more than $1.7 billion, according to Insider Score. Shares dropped around 10% in the fourth quarter and have slid more than 3% since 2026 began. Elsewhere in megacap tech, Ackman slashed more than 38% off his Alphabet holding. He also zeroed out his stake previously worth around $780 million in Chipotle .

<