India is throwing its weight behind AI — but is there substance behind the headlines?

This report is from this week’s CNBC’s “Inside India” newsletter which brings you timely, insightful news and market commentary on the emerging powerhouse. Subscribe here.

The big story

Three years ago, OpenAI CEO Sam Altman told an audience in India, “it’s totally hopeless to compete with us on training foundation models but you should try anyway.” Altman walked back his comments the next day.

A couple of years later, China’s DeepSeek emerged as a contender to OpenAI’s ChatGPT and chatbots from other U.S. tech giants. Indian citizens resurfaced Altman’s comment, declaring that China had already proven him wrong.

India’s Prime Minister Narendra Modi (C) and Brazil’s President Luiz Inacio Lula da Silva (centre L) pose with other world leaders and representatives for a group photo during the AI Impact Summit in New Delhi on February 19, 2026.

Ludovic Marin | Afp | Getty Images

But can India compete with the U.S.? Or, at the very least, can the world’s back office now front the Global South’s AI push, even if it looks too far behind the U.S. and China?

Splashy headlines

Even as the likes of Altman, Google CEO Sundar Pichai, and Anthropic top boss Dario Amodei walk the red carpet at India’s AI Impact Summit, it’s a question as to how far they will go to support India’s belated AI push.

Some of that support has already come over the past few months. Amazon and Microsoft have pledged to invest $50 billion in the country’s AI ecosystem. Blackstone has pumped $600 million in Indian AI infrastructure startup Neysa, and Anthropic has partnered with Infosys to build AI agents, while also opening an office in Bengaluru

India’s government has declared a 400 billion Indian rupee ($4.4 billion) electronics manufacturing push and a tax holiday until 2047 for foreign companies providing cloud services using Indian data centers. Meanwhile, Indian multinational conglomerate Adani has committed $100 billion to develop data centers by 2035 and Tata Consulting Services has plans to set up the world’s largest AI data center.

As for technical advances, India’s Sarvam AI and BharatGen have moved forward on sovereign models, which are developed, owned, or controlled within a country to ensure that critical AI capabilities and data remain under national jurisdiction.

The nation also got its first pure-play AI firm’s IPO in Fractal Analytics.

But do these headline-grabbing stories do enough to tackle the real challenges facing India’s AI story?

Some of these obstacles include the lack of regulation clear enough to encourage the best in the AI business to come to India, beginning the AI race late — where momentum is the moat — and the dire need for huge amounts of capital infusion.

One analyst thinks the challenges haven’t been appropriately addressed yet.

“India is making splashy attempts to kickstart its belated AI push but it is doing so primarily by offering headline grabbing sops without addressing many of the underlying difficulties of actually doing business in India,” said Udith Sikand, senior emerging markets analyst at financial research firm Gavekal.

‘Battle already lost’?

New Delhi, however, is confident of developing its domestic AI industry.

A couple of weeks ago, I interviewed S. Krishnan, secretary at India’s Ministry of Electronics and Information Technology — in other words, the man who runs the ministry responsible for all things AI related — at the CNBC studio in Singapore.

“No industry is without challenges and I don’t think that we should underplay them,” Krishnan told me, but added that he believes it’s “possible” for India to become a “significant player in the semiconductor space in about five to 10 years.”

That said, Gavekal’s Sikand pointed to the fact that most government money is being deployed toward building semiconductor fabs for production rather than encouraging more investment in R&D facilities.

Medianama’s founder Nikhil Pahwa, an early observer of India’s AI progress, wrote that while India’s own models, such as Sarvam, are “fairly good,” that “battle is already lost,” because the adoption of global models is far greater than that of local models in India.

Changing consumer behavior could be difficult, as people are already accustomed to global platforms, making adoption less about technical capabilities and more about user habits.

Optimistic outlook

Still, some critics are emanating positive vibes.

Medianama’s Pahwa suggested the AI summit will end up making the technology a priority for ministries and state governments, reducing overall time for adoption of AI by the system.

Koan Advisory Group’s Vivan Sharan said this is a radically different ideology that has influenced India’s economic policy planning – a development especially stark to someone who has been observing the tech sector for more than 15 years. Now, New Delhi is prioritizing industrial policy around technology in “a very overt manner,” Sharan added

At the start of India’s AI Summit, Altman said India has “all the ingredients to lead in AI” – a dramatic reversal from his pronouncement about the futility of catching up with frontier AI models just three years ago.

But the proof, as they say, will be in the pudding. The ingredients have been laid out – soon it will be time to taste the dish.

Top TV picks on CNBC

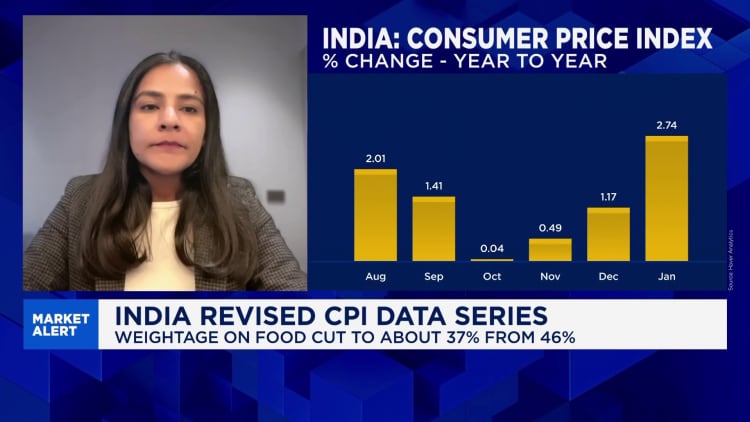

India’s revised CPI data is unlikely to “materially change” the inflation outlook or the Reserve Bank of India’s policy path in the near term, says HDFC Bank’s Sakshi Gupta.

VK Vijayakumar, chief investment strategist at Geojit Financial Services, says foreign investors are likely to rotate back into India as global AI stocks retreat and the AI trade loses momentum.

Need to know

Adani announced a $100 billion investment to develop renewable energy-powered AI-ready data centers by 2035.

India is joining the U.S.-led Pax Silica initiative, the Trump administration’s effort aimed at securing the global supply chain for silicon-based technologies.

Nvidia is partnering venture capital firms in India, including Peak XV, Z47, Elevation Capital, Nexus Venture Partners and Accel India, to identify and fund AI startups.

India is hosting this week the AI Impact Summit, the latest in a series of government-hosted events focused on artificial intelligence. Among the key attendees are OpenAI CEO Sam Altman and Alphabet CEO Sundar Pichai.

In the markets

Indian stocks inched higher amid gains in the region. The Nifty 50 is down almost 2% year to date, data from LSEG showed.

The benchmark 10-year Indian government bond yield ticked up slightly to around 6.678, while the rupee weakened 0.28% to around 91.03 against the dollar.

— Lee Ying Shan

Coming up

Feb. 16-20: India AI Impact Summit

Feb. 20: HSBC flash PMI for February

Feb. 25-26: Indian Prime Minister Narendra Modi to visit Israel

Feb. 25: Gaudium IVF And Women Health IPO opens

Feb. 26: Clean Max Enviro Energy Solutions IPO opens

Each weekday, CNBC’s “Inside India” news show gives you news and market commentary on the emerging powerhouse businesses, and the people behind its rise. Livestream the show on YouTube and catch highlights here.

SHOWTIMES:

U.S.: Sunday-Thursday, 23:00-0000 ET

Asia: Monday-Friday, 11:00-12:00 SIN/HK, 08:30-09:30 India

Europe: Monday-Friday, 0500-06:00 CET

<