JPMorgan Chase could hit $1 trillion market cap

CNBC’s Jim Cramer on Monday reviewed the only six U.S. companies currently valued between $500 billion and $1 trillion, and he ranked JPMorgan Chase as the one most likely to be the next to reach $1 trillion.

“The reason I have JPMorgan as the favorite in this race, with three to one odds, is very simple: the banks are on fire right now, and right now this stock is ridiculously cheap … This thing trades at 15 times this year’s earnings estimates,” he said. “If we get a little multiple expansion and people, say, they start paying 17.5 times next year’s earnings estimates, then JP Morgan wins this race in a heartbeat.”

JPMorgan is the nation’s largest bank, currently valued at more than $836 billion. Cramer praised its CEO, Jamie Dimon, saying the company is run well. He also said JPMorgan has a “fortress balance sheet” that lets the company “consolidate in times of stress” like it did during the mini banking crisis two years ago.

The next most likely candidate is Oracle, Cramer said, adding that the software name might be first in line by looking at its momentum alone. Oracle has seen huge gains alongside the artificial intelligence boom, with its stock climbing more than 200% over the past three years. Shares currently sit up 68.87% year-to-date, and its market cap is about $802 billion.

If Oracle keeps going at its current rate, it should hit $1 trillion soon, Cramer said. However, he said the company is not his top pick because of its enormous deal with ChatGPT maker OpenAI. In July, Oracle agreed to sell $300 billion worth of cloud infrastructure services to OpenAI over five years. Oracle CEO Clay Magouyrk told CNBC earlier this month that he was confident OpenAI would be able to cover these massive costs.

Many major tech names have also take a risk in assuming that OpenAI will be able to pay the large amounts of money it’s committed to spend, Cramer continued, including Nvidia, Broadcom, CoreWeave AMD. But “no one needs them to be good for it like Oracle does,” Cramer said, stressing that Oracle is expecting $60 billion per year as part of the deal.

Cramer’s third favorite to reach $1 trillion is Walmart, which is valued at nearly $833 billion. He said the big box chain has made some major improvements, and its scale allows it to cope with new tariffs better than most of its peers. However, he noted that the stock has had a huge run and is trading at very high levels for a retailer compared to this year’s earnings estimates.

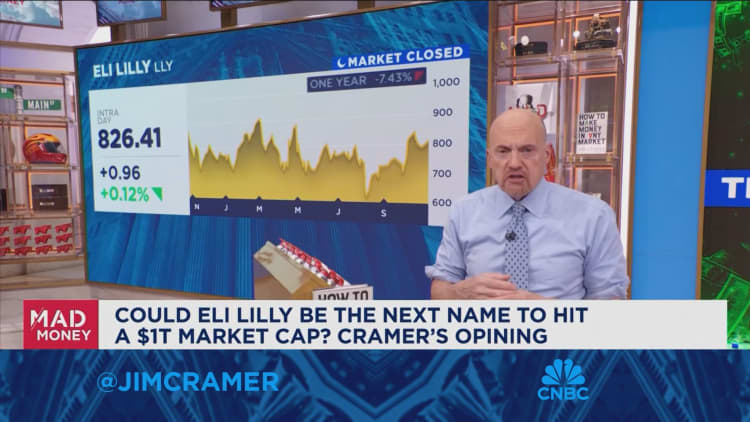

Eli Lilly is the fourth-most likely candidate, Cramer continued, suggesting the $782 billion company is the most valuable healthcare outfit in the world. Eli Lilly has ballooned over the past few years due in part to its popular GLP-1 weight loss and diabetes drug, and Cramer noted that the stock got close to trillionaire status last summer peaking at more than $900 billion.

But Cramer said the stock has been choppy since then, in part due to potential regulatory headwinds and worries about competition from Novo Nordisk and other drug companies working on similar products. He said Eli Lilly needs a catalyst to get going, such as approval for a new use of its GLP-1 drug or progress on the medicine’s pill form.

Cramer named Visa and Mastercard as lesser contenders for the $1 trillion title, with the former currently worth a little over $670 billion and the latter at more than $517 billion. He suggested these companies aren’t likely to jump ahead of their peers, but they have potential in the long run if they keep putting up steady growth.

“Like Mastercard, though, Visa doesn’t really have the juice to leapfrog its more richly-valued competitors in the trillion-dollar race,” Cramer said. “But, man, this stock’s given shareholders an annual equivalent gain of about 17% for the past decade — if they keep it up, Visa should be a trillionaire within three years. And I bet Visa gets there, I just doubt they’ll get there first.”

Sign up now for the CNBC Investing Club to follow Jim Cramer’s every move in the market.

Disclaimer The CNBC Investing Club holds shares of Eli Lilly.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer’s world? Hit him up!

Mad Money Twitter – Jim Cramer Twitter – Facebook – Instagram

Questions, comments, suggestions for the “Mad Money” website? madcap@cnbc.com

<