The Fed is likely to keep cutting interest rates, but multiple dangers lurk, CNBC survey finds

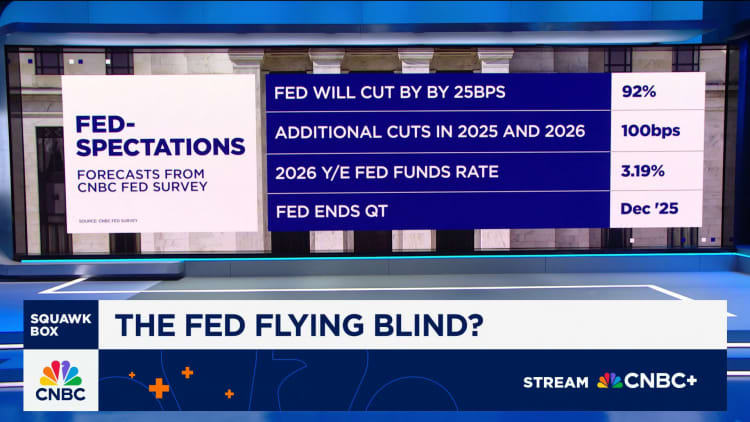

The Federal Reserve is expected to lower interest rates by a quarter point at its meeting this week and could cut at the next two meetings as well, according to the October CNBC Fed Survey.

But there were concerns among the 38 survey respondents, who include economists, strategists and fund managers, about the lack of data from the shutdown, an artificial intelligence bubble, still-high inflation and whether politics is playing a role in the Fed’s decisions.

“Flying in a blizzard with a blindfold on and no backup instrumentation isn’t a great place for monetary policy,” said Guy LeBas, chief fixed income strategist at Janney Montgomery Scott. “It’s even worse when there are mountains in the area.”

While 92% of respondents believe the Fed will cut at this meeting, only 66% believe it should, with a 38% minority opposing a rate cut.

“Politics rather than financial conditions are clearly influencing the Fed’s rate decisions,” said Richard Bernstein, CEO of Richard Bernstein Advisors. “Financial conditions are near historically easy, GDP is tracking 3.5-4%, financial assets are ripping, and inflation remains well above the Fed’s target. In more normal times, there is no way the Fed would be cutting rates.”

Following the cut this week, 84% of respondents see another reduction in December, and 54% see a third in January. A total of 100 basis points of rate cuts are forecast this year and next, bringing the funds rate down to 3.2% by the end of 2026.

Though some think the Fed shouldn’t cut, there’s a contingent of those looking for even larger moves.

“Labor market weakness and the government shutdown are increasing recession risk and suggesting preemptive bigger rate cuts are necessary,” said Allen Sinai, chief economist and strategist at Decision Economics. “The productivity boom in process is the main reason for the economy’s resiliency and for the stunning equity market boom that is not a bubble.”

Views on stocks, economy

Nearly 80% of respondents say stocks related to AI are extremely or somewhat overvalued and by an average of more than 20%. As a result, they believe stocks will end the year close to the current level and rise only a modest 5% next year, though the S&P will top 7,200 and near 7,700 by 2027.

“The single most important short- and long-run dynamic in the U.S. macro landscape is artificial intelligence (AI) and whether it is over-, under- or appropriately hyped,” said Troy Ludtka, senior US economist at SMBC Nikko Securities Americas.

John Lonski, president of the Lonski Group, was more definitive: “Once the AI bubble bursts, only the financially strong participants in the AI space will survive.”

The government shutdown, according to 82% of those surveyed, is not seen having an impact on stocks. Some 45% of respondents see the shutdown ending this month and another 34% see it over by November.

Most expect the average monthly cost of 0.3% of GDP to be mostly or entirely recouped following the reopening of the government. But only 5% are “extremely confident” and 71% are “somewhat confident” they are getting an accurate picture of the economy from the available data being published.

“Fed officials are unable to draw much of a conclusion about anything and therefore should arguably remain on hold, waiting for additional information before potentially further compounding a policy error with a second-round rate cut if unwarranted by the evolution of inflation and hiring conditions,” said Lindsey Piegza, chief economist at Stifel.

Respondents were evenly divided about the risk of the Fed easing without enough data, with 42% saying the risk is that the central bank cuts too much and 40% saying the risk is it cuts too little.

Growth forecasts edged up again, the fifth time in the six surveys since the reciprocal tariffs were announced in April.

GDP is now seen at 1.9% for the year, 2.2% in 2026 and 2.3% in 2027. The unemployment rate is seen topping at around 4.5% next year while Inflation is forecast to end the year around 3% and to drop only marginally in 2026 to 2.8% and modestly again to 2.6% in 2027.

Tariffs remain the No. 1 risk to the economic expansion but nearly two-thirds of respondents say the impact so far on inflation has been less than they expected.

Yet forecasters believe they will eventually be right; the top reason cited for lower tariff inflation is that “the full impact on consumer prices has yet to be felt.” The second most cited answer is because companies are not passing along as much of the tariffs as expected, a situation that some believe won’t last.

<