We’re upgrading shares of a big beneficiary of AI spending going through the roof

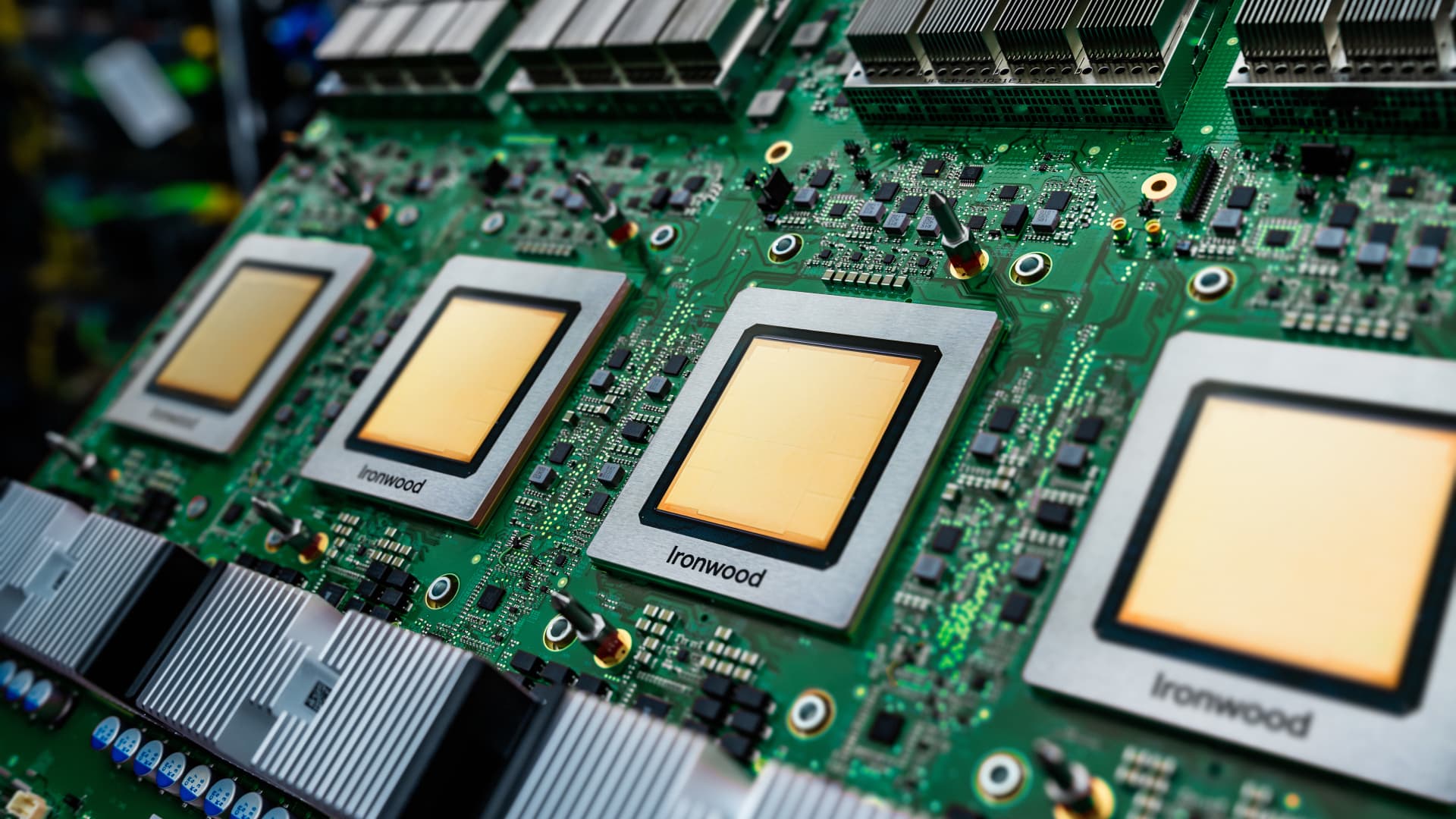

Every weekday, the CNBC Investing Club with Jim Cramer releases the Homestretch — an actionable afternoon update, just in time for the last hour of trading on Wall Street. Stocks were rebounding Friday. After a terrible week, technology was leading Friday’s market higher — even as Amazon , technically in the consumer discretionary bucket, pulls back after earnings. For the week, the S & P 500 and the Nasdaq were still lower. There has been a lot of damage to the tech trade as enterprise software stocks sold off on fears that AI tools will displace their business. While software names such as Club names Salesforce , CrowdStrike , and Palo Alto Networks fell by more than 10% and the Magnificent Seven struggled, about 11 other Club stocks posted gains of more than 5%, helping our diversified portfolio withstand the market pain. The best performing sector this week was consumer staples — up 13% in 2026 as a group and having their best year in decades, according to Bank of America. Staples were hated for so long, and this quick change in sentiment for this dependable but lower growth group prompted us on Wednesday to downgrade Procter & Gamble to our hold-equivalent 2 rating . We’re through hyperscalers’ earnings. A consistent message from management teams is the need to ramp spending to build out AI infrastructure to meet demand. Meta Platforms invested $22.14 billion in the fourth quarter and $72.22 billion for the full year 2025 and said in 2026 it anticipates spending another $115 billion to $135 billion. Microsoft spent $37.5 billion on capex, and analysts are modeling $148 billion over the company’s fiscal year. Alphabet said this week it spent $27.5 billion on capex during the fourth quarter and $91.4 billion over the year. That figure is expected to surge to the range of $175 billion to $185 billion in 2026. Finally, Amazon spent about $39.5 billion in capex during the fourth quarter and $128 billion in 2025. It plans to be the most aggressive of them all in 2026 by investing $200 billion. The doubling of capex year over year will be beneficial to the earnings and backlogs of so many different companies in the portfolio. On the chip side, it should mean a lot of spending on Nvidia ‘s latest GPUs. In the industrial sector, Eaton ‘s electrical equipment is used within data centers, and GE Vernova ‘s natural gas turbines are necessary in power data centers. The company also provides electrification and grid management solutions. Dover makes heat exchangers used to cool servers inside data centers. Corning ‘s fiber cabling is essential for AI data center connectivity. Cisco Systems and Qnity Electronics play an important role in the AI buildout, too. The stock we want to bring attention to is Broadcom . Shares of the semiconductor and infrastructure software company are down about 4% year to date and 20% from their Dec. 10 all-time high of about $413. Given what we have learned about the spending plans from Alphabet and Meta – two major Broadcom custom chip clients – we’re upgrading Broadcom back to our buy-equivalent 1 rating. Alphabet’s doubling of capex plans has made us more confident that Broadcom can beat earnings estimates this year, and the stock’s pullback from the high offers an attractive entry point. Broadcom reports earnings early next month. The pace of earnings season cools next week. But there’s still about 15% of S & P 500 companies scheduled to report. Within the portfolio, we get quarterly reports from DuPont and Cisco . Some other big earnings reports include Marriott , Coca-Cola , McDonald’s , Dutch Bros , Applied Materials , and CVS Health . Economic data heats up next week , with December retail sales and the January consumer price index. The most important economic numbers come Wednesday, with the January employment report, which was delayed this past week due to the brief government shutdown. The market did not like it this week when December job openings fell to their lowest levels in more than five years, and layoff data from Challenger were at their highest January levels since 2009. Economists currently expect nonfarm job gains of about 70,000 in January, with the nation’s unemployment rate staying unchanged at 4.4%. (See here for a full list of the stocks in Jim Cramer’s Charitable Trust.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

<